Legal & Financial

Legal System

The legal system in Cyprus is modeled on the British system due to its colonial legacy. In addition, with EU membership, Cyprus has harmonized its laws and regulations in line with the acquis communautaire. In effect, this means that EU citizens can now buy more than one property in Cyprus.

The Land Registry system is one of the most advanced and reliable systems in the world, being based on the British equivalent. Purchasers of property in Cyprus will be far more secure with regards to matters such as title deeds than they might be in other Mediterranean countries. All legal information regarding the legal procedures associated with purchasing property in Cyprus is available from our Legal Associates.

Personal Income Tax

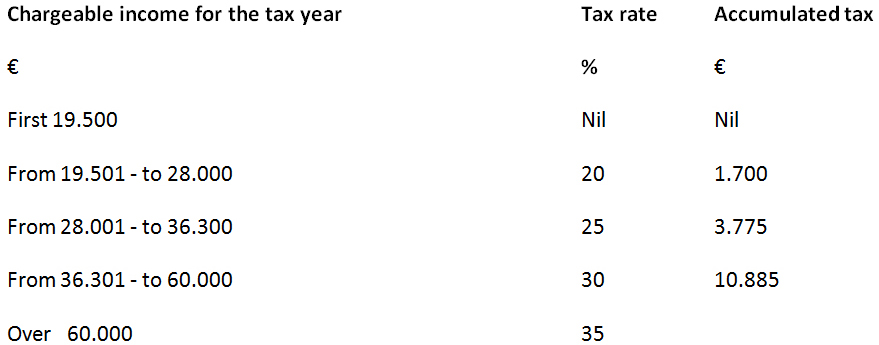

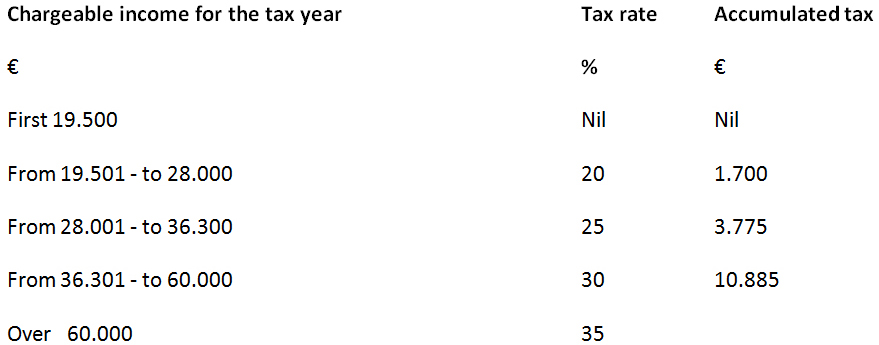

All Cyprus tax resident individuals are taxed on all chargeable income accrued or derived from all sources in Cyprus and abroad. Individuals who are not tax residents of Cyprus are taxed on certain income accrued or derived from sources in Cyprus.

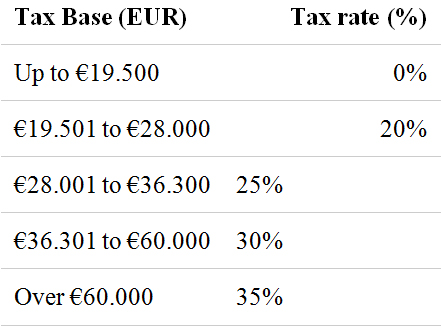

Personal tax rates

The following income tax rates apply to individuals:

Foreign pension income is taxed at the rate of 5%. An annual exemption of €3.420 is granted. The taxpayer can however elect to be taxed at the normal tax rates and bands set out above. This is a choice which may be made year-on-year.

Corporation tax

All Cyprus tax resident companies are taxed on their income accrued or derived from all chargeable sources in Cyprus and abroad. A non- Cyprus tax resident company is taxed on income accrued or derived from a business activity which is carried out through a permanent establishment in Cyprus and on certain income arising from sources in Cyprus. A company is a resident of Cyprus if it is managed and controlled in Cyprus.

Foreign taxes paid can be credited against the corporation tax liability. The corporation tax rate for all companies is 12.5 % There are several tax deductions for expenses There are several exemptions and deductions.

Value Added Tax

VAT is imposed on the supply of goods and provision services in Cyprus, as well as on the acquisition of goods from the European Union (EU) and the importation of goods into Cyprus. Taxable persons charge VAT on their taxable supplies (output tax) and are charged with VAT on goods or services which they receive (input tax).

If output tax in a VAT period exceeds total input tax, a payment has to be made to the State. If input tax exceeds output tax, the excess input tax is carried forward as a credit and set off against future output VAT. Imposition of the reduced rate of 5% on the acquisition and/or construction of residences for use as the primary and permanent place of residence.

VAT rates

The legislation provides for the following four tax rates:

Zero rate (0%)

Reduced rate of five per cent (5%)

Reduced rate of nine per cent (9%)

Standard rate of nineteen percent (19%)

Registration to the VAT

Registration is compulsory for businesses with (a) turnover subject to VAT in excess of €15.600 during the 12 preceding months or (b) expected turnover subject to VAT in excess of €15.600 within the next 30 days. Businesses with turnover of less than €15.600 or with supplies that are outside the scope of VAT but for which the right to claim the amount of the related input VAT is granted, have the option to register on a voluntary basis.

VAT declaration – payment/refund

VAT returns must be submitted quarterly and the payment of the VAT must be made by the 10th day of the second month that follows the month in which the tax period ends.

Social insurance

The contribution rate for employees will change on 2019,2024,2029,2034 and 2039. The contributions of self-employed persons are 14.6% of their income.

Social insurance contributions are restricted to a maximum amount that is usually increased annually. In case that the wage or salary is higher than the maximum amount, no contribution is paid on that higher amount.

PROPERTY OWNERSHIP

Compared to many countries Cyprus has flexible property buying procedures. People of Cypriot origin and EU citizens are allowed to purchase however much property they choose. A non-EU citizen is entitled to FREEHOLD ownership of a villa, apartment, or a piece of land of up to 4,014 m2.

International business units may also acquire premises for their activities or for residence of their foreign employees.

Procedure of property purchase in Cyprus

Procedure of property purchase in Cyprus

How to buy property in Cyprus

The Cyprus property market is actively developing, so buying a property on the island can be viewed as a promising returning investment. Our company has ready for delivery various exclusively own luxury properties as many brand projects are coming soon!

- Select an object

In our portfolio, you can find various, exclusively own luxury properties, of different pricerange located in Limassol. Before you purchase your property in Cyprus, you may go on an inspection trip. Our Company’s Special Team will help you to personally inspect all the properties that might be upon your interest in order to make easier your final choice.

- Conclusion of the preliminary contract

This document allows the buyer to reserve the selected option. After signing it, the property is withdrawn from selling list. At this stage, the legal purity of the property is checked, and the final terms of the transaction are agreed. Either the licensed lawyer hired by the buyer carries out all necessary actions or alternatively, we can offer you free of charge legal services for the specific purposeby ourlegal associates.At this stage, you also need to make a reservation deposit. As a rule, it is about 1–2 % of the property cost.

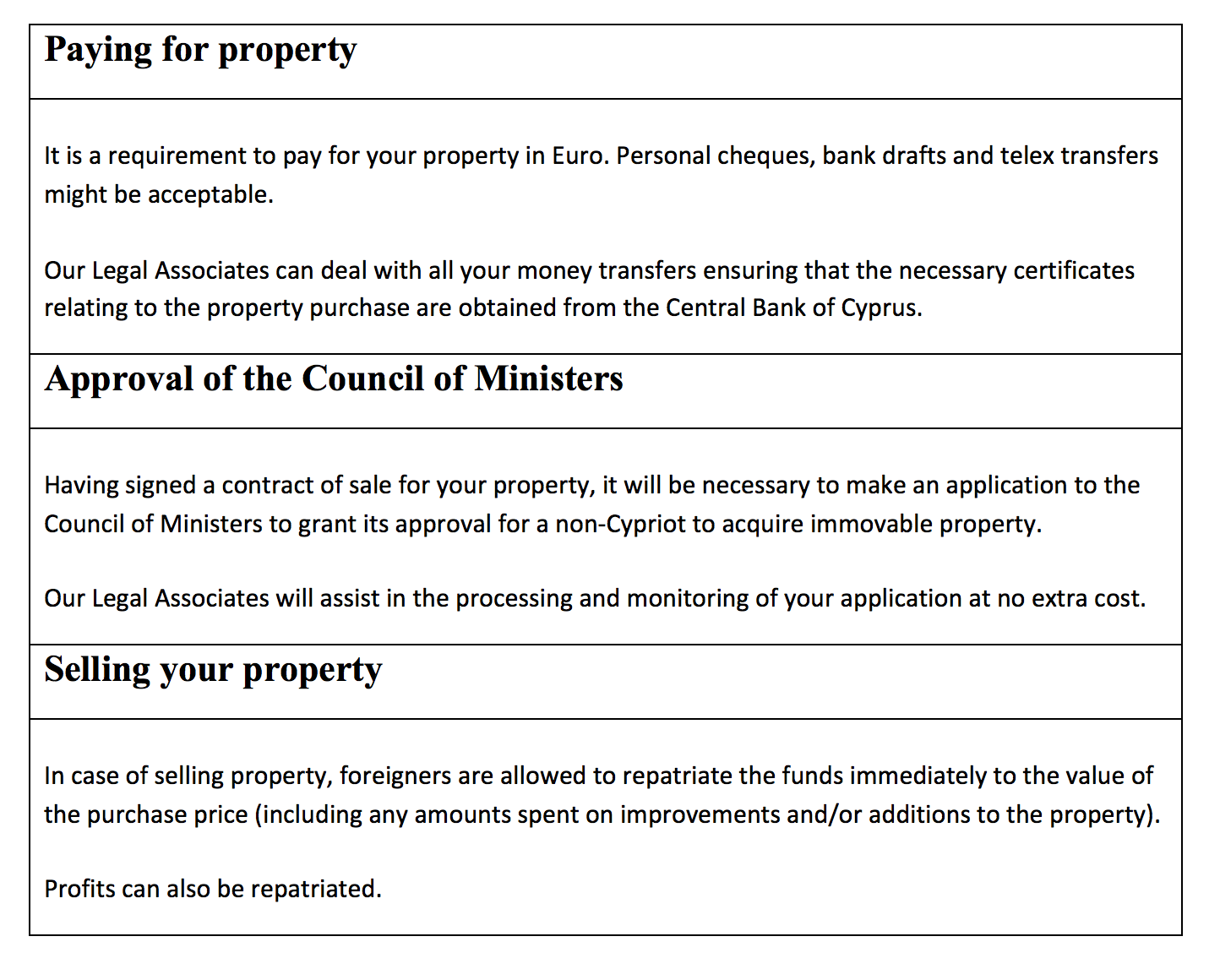

- Opening an account in one of the Cyprus banks

It is a requirement to pay for your property in Euro. It would be preferable to open a bank account in one of the Cyprus Banks. Either Way Personal cheques, bank drafts and telex transfers might be acceptable.

Our Legal Associates can deal with bank account opening and all your money transfers ensuring that the necessary certificate relating to the property purchase is obtained from the Central Bank of Cyprus.

- Preparation of the sale contract

When the preparatory stage is completed, you can proceed to the final stage of the transaction. When signing a contract of sale, an attorney must file an application to the Cyprus Council of Ministers and obtain a permit. As a rule, this process is a mere formality. Our legal associates can assist you on that matter.

- Registration of documents

A purchase must be registered in the district land department. A package of documents is collected and submitted by a lawyer. After registration, information about the purchased property is entered in the land registry. This serves as a confirmation of the ownership right until the title of the owner is obtained.

- Completion of mutual settlements

Payment can be transferred directly to the seller’s account. If the property has not been completed, it is recommended to use the ESCROW system, which most Cypriot lawyers will offer you. In this case, the amount of payment will be transferred to the seller gradually, as construction progresses.

- Obtaining the owner title for the purchased real estate

If you purchase a used property then the procedure is very easy and almoststraightforward (please readbelow) If you purchase a new completed property or a property under construction then a mandatory period of approximately 18 moths willbe needed.

(Transfer of Immovable Property)

The Immovable Property (Transfer and Mortgage) Law 9/65

Transfer of immovable property means the passing of the title of immovable property from one person (the transferor) to another (the transferee) by the voluntary act of such persons.

Transfer Requirements

Completion of Form N.270 (Declaration of Transfer of Immovable Property). The certificate of registration (title) of the immovable property, which is to be transferred, must be attached thereto. Where the transfer of the property takes place at a Lands Office other than the Lands Office of the District where the property is situated Form N.270 must be completed in duplicate.

Completion of Form N.313.

Production of the receipts of payment of all fees, charges and taxes payable for theproperty under transfer. Such fees, charges and taxes may be one or more than the following:

- Immovable Property Tax.

- Capital gains tax.

(Receipts of payment for all the above taxes and duties may be obtained from the InternalRevenue Department).

- Sewerage Board Tax. (Receipt obtained from the Sewerage Board).

- Town rate. (Receipt obtained from the municipality in whose boundaries the property is situated).

- Communal rate. (Receipt obtained from the community in whose boundaries the property is situated).

Transfer

All documents mentioned above must be completed and signed by the interested persons and deposited with the Lands Office accepting the transfer.

Acceptance of Transfer

The acceptance of the transfer is effected by order of priority. Both parties must appear either in person or by agent and produce their identity card or other documents proving the same before the Lands Officer accepting the transfer.

- Disabled persons must be represented by their lawful agent or any agent appointed by the Court or any other person.

- Corporate bodies are represented by those persons who manage their affairs in accordance with the statutes, the law or any regulation.

Transfer Fees

The procedure for acceptance is completed upon the calculation and the payment of the fees by the transferor to the Lands and Surveys Department.

The fees payable vary depending on the kind of transfer and are determined based on the assessed value, or on the market value of the property under transfer.

Assessed value means the value of the property recorded in the Land Register.

Time required for completion of the procedure

Transfers without particular problems may be completed within one hour. In this case the registration of the immovable property and the delivery of the titles to the parties may be made on the same day, provided all interested parties appear at the Office on time. If not, the title is issued on the next following days depending on the accumulated work volume and the available personnel.

Other information

For complex cases the public is advised to apply to the Competent Land Officer in charge of the Declarations Branch of the appropriate District Lands Office.

Property taxes/fees

GOOD NEWS FOR PROPERTY BUYERS Property Transfer Fees reduction of 50% is now permanent.

The Cyprus Finance Ministry announced that the temporary arrangement to reduce Property Transfer Fees by 50 per cent, is now PERMANENT; the law implementing the change, ‘Land and Surveys Department (Fees and Rights) (Amendment) (No. 2) Law’, was passed on 14th JULY 2016 at a plenary session of the Cyprus parliament.

In its announcement the Finance Ministry stated “The above arrangement aims to boost additional growth in the construction industry and attract new investments from both the domestic, and the foreign markets.”

Property Transfer Fees: these are necessary in order to transfer FREEHOLD ownership to your name.

This can be done as soon as the relevant Government Authority has issued the title deed and the purchase has been settled.

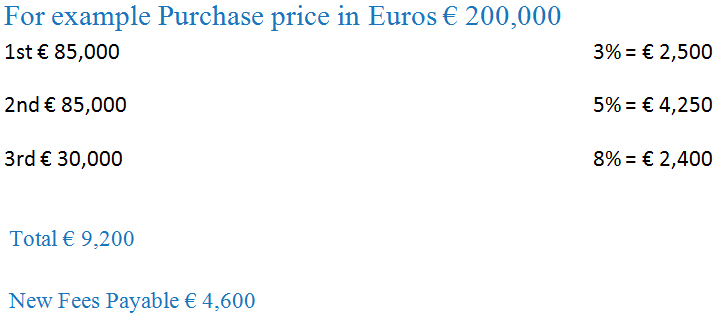

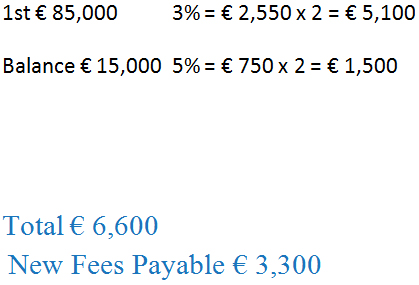

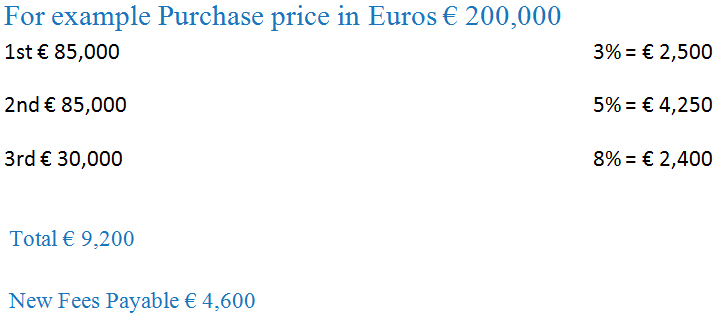

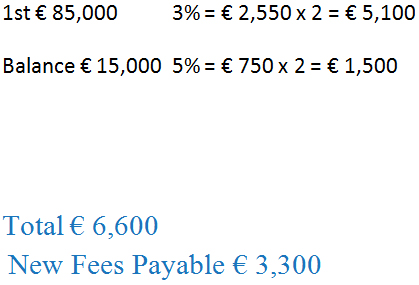

The Property Transfer Fees are payable once only to the Land Registry Office according to the following scale:

However, if the property is purchased jointly by a couple (as is often the case) the property purchase price is split equally into two parts and then taxed, which is beneficial to the purchasers as the following example shows:

Capital Gains Tax:

Capital Gains Tax is imposed (when the disposal is not subject to income tax) at the rate of 20% on gains from the disposal of immovable property situated in Cyprus including gains from the disposal of shares in companies which own such immovable property, excluding shares listed on any recognized stock exchange.

The following disposals of immovable property are not subject to Capital Gains Tax:

– Transfers arising on death

– Gifts made from parent to child or between husband and wife or between up to third degree relatives

– Gifts to a company where the company’s shareholders are members of the donor’s family

– Gifts by a family company to its shareholders

– Gifts to charities and the Government

– Exchange of properties

Liability is confined to gains accruing since 1 January 1980. The costs that are deducted from gross proceeds on the disposal of immovable property are its market value at 1 January 1980, or the costs of acquisition and improvements of the property, if made after 1 January 1980, as adjusted for inflation up to the date of disposal on the basis of the consumer price index in Cyprus. Expenses that are related to the acquisition and disposal of immovable property are also deducted, subject to certain conditions e.g. transfer fees, legal expenses etc.

Individuals can deduct from the capital gain the following:

– Disposal of private residence (subject to certain conditions) 85.430

– Disposal of agricultural land by a farmer 25.629

– Any other disposal 17.086

The above exemptions are lifetime exemptions subject to an overall lifetime maximum of €85.430

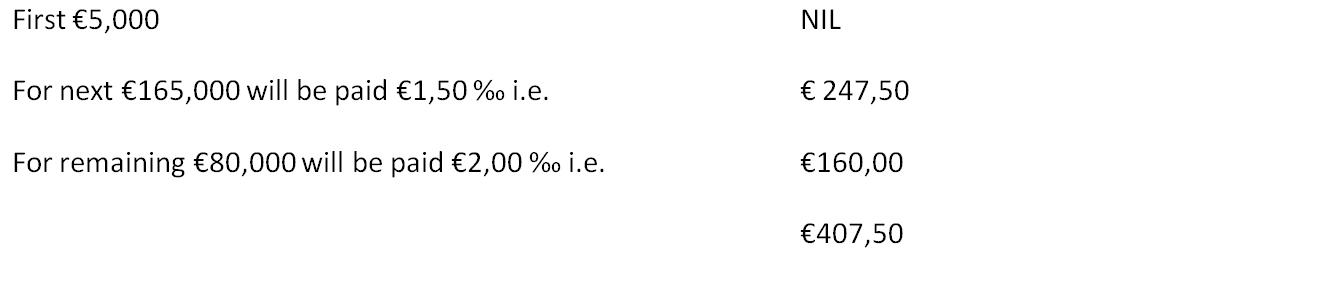

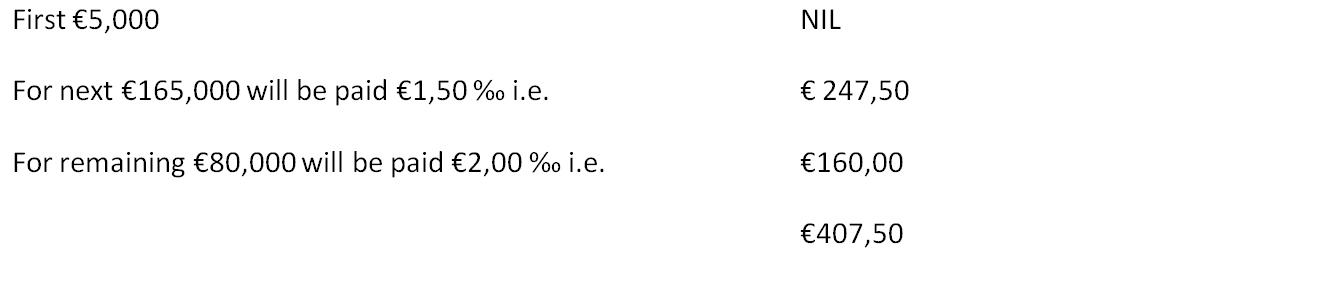

Stamp Duty:

Based on the new modified law for stamp duties 173 (1) 2013 which is in force as from 1st March 2013, stamp duty payable on the Contracts of Sale will be as follows:

The first 5,000 NIL

5,001-170,000 1,50 ‰ on the value or part thereof

Over 170,001 2,00 ‰ on the value or part thereof with a MAXIMUM LIMIT of €20,000

Example Contract of Sale value €250,000

There is a maximum limit of stamp duty to be paid for one Contract of Sale/ agreement which is €20,000.

Estate Duty

Estate Duty has been abolished since 1 January 2000. The executor/ administrator of the estate of the deceased, is required by the Deceased Persons Estate Law, to submit to the tax authorities a statement of assets and liabilities of the deceased within six months from the date of death.

Disclaimer

The information contained in these pages is considered accurate and reliable at the time of release without guaranteeing absolute accuracy and completeness at any time.

Cyprus gives you the time and the freedom to enjoy life at a slower pace within a truly welcoming environment. Small enough to ensure that a new experience is always close by, but large enough to provide attractions for all ages and lifestyles; Cyprus offers every kind of pleasure under the sun for at least 320 days per year! The rest time you can even ski in the mountains just 40 minutes drive from Limassol or Nicosia.

Cyprus gives you the time and the freedom to enjoy life at a slower pace within a truly welcoming environment. Small enough to ensure that a new experience is always close by, but large enough to provide attractions for all ages and lifestyles; Cyprus offers every kind of pleasure under the sun for at least 320 days per year! The rest time you can even ski in the mountains just 40 minutes drive from Limassol or Nicosia.

Procedure of property purchase in Cyprus

Procedure of property purchase in Cyprus